|

|

Post by alancalverd on Nov 5, 2012 15:04:30 GMT 1

The object of modern government is to ensure that the hand on the tiller is related to the hand in the till. When you have a change of government, or even a cabinet reshuffle, a quick look at the share portfolios of spouses and siblings will give you a good guide to short-term policy.

|

|

|

|

Post by marchesarosa on Dec 2, 2012 13:55:27 GMT 1

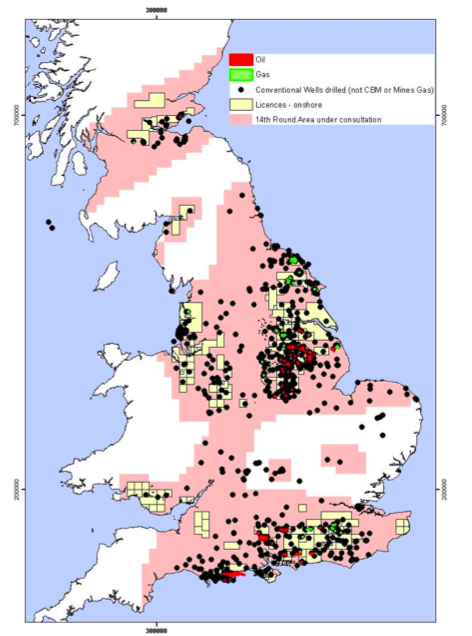

Lucrative tax breaks to spur boom in shale gas exploration: Chancellor to cut reliance on supplies from abroadBy TOM MCGHIE 1 December 2012 Tax breaks: Chancellor George Osborne is keen to boost domestic gas exploration A massive expansion of controversial shale gas exploration – known as fracking – will be triggered by George Osborne when he unveils lucrative tax breaks this week. While the Chancellor’s announcement in Wednesday’s Autumn Statement will be welcomed by the energy industry, it will alarm environmentalists.They fear that the technique, which involves creating explosions deep underground to release gas, has the potential to contaminate ground water and they point out that it has already caused earthquakes. In October, Osborne made it clear that he wanted to offer the fledgling shale gas industry a ‘generous new tax regime’ to encourage fracking exploration. This week he will make good his promise. He will confirm in his statement that Britain is sitting on shale gas reserves worth £1.5trillion that could yield the country huge economic benefits. The British Geological Survey, which has been commissioned by the Department of Energy to find out the extent of British reserves, has identified vast deposits of shale gas in the North West, North Wales, the Isle of Man, South Cumbria, East Midlands and the North East. The huge extent of the gas fields is much bigger than previously thought and if exploited would potentially bring energy price stability and independence from imports for decades. Even though only about ten per cent of the gas is in unpopulated areas suitable for extraction, it would still be worth £150billion. The Chancellor is desperate to boost domestic gas exploration as a way of reducing Britain’s dependence on foreign gas supplies.The sharp decline in North Sea gas finds makes Britain more reliant on energy supplies from Qatar, Russia and the US. Osborne plans to exclude fracking from the current oil and tax regime. Instead it will benefit from targeted tax breaks aimed at encouraging investment. To further emphasise the importance of gas to the economy, the Chancellor has instructed the Department of Energy to publish its long-awaited Gas Strategy document on the same day as the Autumn Statement. This will show how crucially important gas is to energy security in Britain. Not only is gas ‘clean’ compared with coal and oil, it is also relatively cheap to build gas plants. At least 22 gas-fired plants are required to be built to help plug the energy gap over the next ten years as old coal and nuclear power stations are closed down. Gas-fired plants will be used only intermittently – in winter when demand is highest and when there is no wind to blow turbines – so they are uneconomic. Therefore power companies will need encouragement to start building them. The Gas Strategy document will outline how the Government aims to subsidise the work. www.thisismoney.co.uk/money/news/article-2241465/Lucrative-tax-breaks-spur-boom-shale-gas-exploration-Chancellor-cut-reliance-supplies-abroad.html#ixzz2DqZQi6yq

|

|

|

|

Post by marchesarosa on Dec 3, 2012 10:58:33 GMT 1

|

|

|

|

Post by marchesarosa on Dec 3, 2012 12:54:40 GMT 1

Nick Grealy's blog on Fracking www.nohotair.co.uk/Steel Yourself: UK Shale Gas and the Steel Industry |

|

|

|

Post by marchesarosa on Dec 3, 2012 12:56:13 GMT 1

Public Media for Public Understanding EXPLORE SHALE An exploration of natural gas drilling and development in the Marcellus Shale. Learn More about this Project exploreshale.org/ |

|

|

|

Post by marchesarosa on Dec 13, 2012 0:40:14 GMT 1

|

|

|

|

Post by marchesarosa on Dec 13, 2012 14:59:09 GMT 1

|

|

|

|

Post by marchesarosa on Dec 14, 2012 16:16:11 GMT 1

|

|

|

|

Post by marchesarosa on Dec 14, 2012 16:20:01 GMT 1

Will the government really tun its nose up to tax revenue, jobs and a stimulus to the economy for the sake of protecting renewables from competition?

|

|

|

|

Post by marchesarosa on Jan 24, 2013 19:48:57 GMT 1

Up to 233 billion barrels of oil discovered in southern AustraliaPosted on January 24, 2013 by Anthony Watts From the Telegraph: The discovery in central Australia was reported by Linc Energy to the stock exchange and was based on two consultants reports, though it is not yet known how commercially viable it will be to access the oil.

The reports estimated the company’s 16 million acres of land in the Arckaringa Basin in South Australia contain between 133 billion and 233 billion barrels of shale oil trapped in the region’s rocks.

The find was likened to the Bakken and Eagle Ford shale oil projects in the US, which have resulted in massive outflows and have led to predictions that the US could overtake Saudi Arabia as the world’s largest oil producer as soon as this year. www.telegraph.co.uk/news/worldnews/australiaandthepacific/australia/9822955/Trillions-of-dollars-worth-of-oil-found-in-Australian-outback.htmlWUWT reader John V. Wright in his Tip and Notes submission writes: This is a huge problem for PM Gillard. No one lives out there so all the usual garbage about shale oil extraction causing earthquakes and threatening people’s home will not wash. So now she has got to get thinking – how can I put the kibosh on this fantastic energy windfall for Australia without it being completely obvious that I am only interested in squeezing every last ‘green’ tax dollar out of the idiots who voted for me last time? wattsupwiththat.com/2013/01/24/up-to-233-billion-barrels-of-oil-discovered-in-southern-australia/

|

|

|

|

Post by marchesarosa on Feb 1, 2013 10:53:50 GMT 1

UK’S ‘VAST’ SHALE GAS STASH COULD SLASH EUROPEAN GAS PRICES Date: 31/01/13 Helene Robertson, Petroleum Economist The UK has vast shale-gas reserves that could cause domestic and European natural gas prices to tumble, according to author of a new report, due for release in the next few months. Gordon Pickering, director of Navigant Consulting, told Petroleum Economist that the company had been commissioned by the UK’s Department of Energy and Climate Change (DECC) to assess the country’s shale-gas resource potential. Pickering declined to state the exact figure the consultancy had given DECC in the report, but said the government was reviewing it and the results would be released within the next few months. ”This is potentially a very significant resource in the UK. Compared to other countries in Europe there is a better chance of things moving forward in unconventional gas,” Pickering said. “It’s very promising and I’m very excited about the resources in the UK.” www.petroleum-economist.com/Article/3149203/News-and-Analysis-Archive/UKs-vast-shale-gas-stash-could-slash-Europe-gas-prices.html |

|

|

|

Post by principled on Feb 1, 2013 22:46:03 GMT 1

Marchesa Forgive me for seeming just a tad cynical, but I can hear the treasury bods talking about this already... "Yes, the report says that prices will fall by 60-80% like in the US when the gas comes on stream" "60-80%, you say? Hmm. Time for a new tax, by jove" "But how are we going to convince the electorate that maintaining the high energy price is in their interest?" "Simple old bean. We'll just call it the Climate Reinforcement Action Protocol tax or CRAP for short?" "But what rate are we going to set it at?" "Good God man, have you no grey matter? It'll be the difference between the gas price now and the price when fracking gas comes on stream. Plus inflation, naturally." "Now do be a good fellow and toddle off and get me a white Darjeeling, I'm feeling quite exhausted after that mental exertion". P  |

|

|

|

Post by marchesarosa on Feb 2, 2013 9:43:30 GMT 1

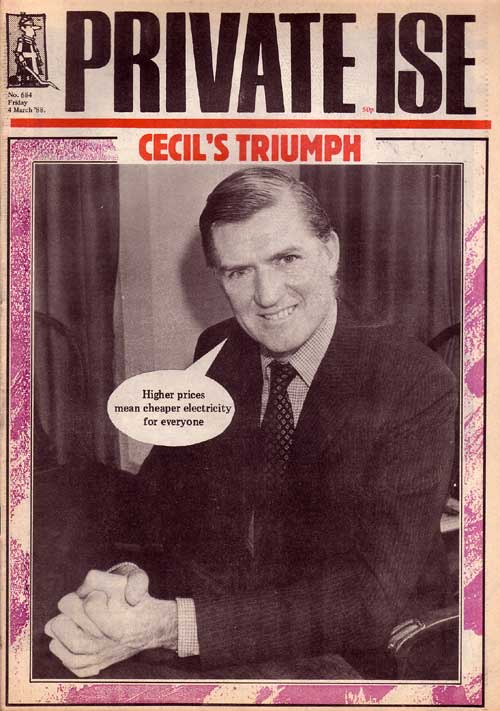

Bishop Hill commenters summed it up. ZT said Raising taxes actually reduces bills, as Huhne patiently explains to Paxton www.youtube.com/watch?v=JSqblDWwDQI. Raising taxes, increases prices, which reduces demand, which reduces bills (by 7%). Simples. and Cappell recalls a Private Eye cover at the time of Privatisation featuring Cecil Parkinson  Issue: 684 Date: 4 March 1988 |

|

|

|

Post by principled on Feb 2, 2013 17:37:18 GMT 1

Marchesa And there was ME thinking I was being just a tad cynical in my contribution! I should have known better.  Based on the Private Eye page I can't help feeling that any day now I'm going to see the headline. "Transport minister says square wheels reduce fuel usage" Doh!  P |

|

|

|

Post by marchesarosa on Feb 9, 2013 13:47:13 GMT 1

The Times seems to have got sight of the British Geological Survey's new estimates of Britain's shale gas resource. The previous figure of 1000 trillion cubic feet, widely pooh-poohed by greens, has been upped to between 1300 and 1500 tcf. Current UK demand is about 3 trillion cubic feet per annum!Harrabin called the reserves "meagre" last October! Prat! TOO GOOD TO BE TRUE? ‘BRITAIN HAS SHALE GAS FOR 1500 YEARS’

Britain has shale gas for 1,500 years, but bills won’t be lower (Of course, not! Wouldn't want to queer the pitch for the uneconomic yet lucrative renewables gravy train! Date: 09/02/13 Tim Webb, Rachel Sylvester and Alice Thomson, The Times Britain could have enough shale gas to heat every home for 1,500 years, according to new estimates that suggest reserves are 200 times greater than experts previously believed. The British Geological Survey is understood to have increased dramatically its official estimate of the amount of shale gas to between 1,300 trillion and 1,700 trillion cubic feet, dwarfing its previous estimate of 5.3 trillion cubic feet.  According to industry sources, the revised estimates will be published by the Government next month, fuelling hopes that new “fracking” techniques to capture trapped resources will result in cheaper energy bills. It is thought that it will be technically possible to recover up to a fifth of this gas, making Britain’s shale rocks potentially as bountiful as those in the US. Experts stressed that it was still much too early to say how much of the gas it would be economic to get out of the ground to heat homes and help to generate electricity.  In an interview with The Times today, Ed Davey, the Energy and Climate Change Secretary, tries to downplay hopes of a shale gas glut in the UK pushing down household heating bills, which are at record highs. “It is not the golden goose. The experts are clear that they do not expect this to have a major impact on the gas price.” The UK Onshore Operators Group (UKOOG), which also represents other onshore oil and gas producers, is aiming to win over public opinion about the shale gas industry, in particular by countering claims that the process of fracking poses an environmental menace. The shale gas industry is gearing up for a year of intense activity after the Government lifted an 18-month moratorium on fracking in December. The ban was imposed in May 2011 after Cuadrilla Resources, the explorer backed by Lord Browne of Madingley, the former chief executive of BP, set off dozens of earth tremors when it began fracking on sites near Blackpool. The company intends to resume fracking this summer to find out more about the size and commercial potential of its reserves. Other explorers sitting on vast shale gas deposits will also apply for fracking licences soon. Government officials are preparing to hold an onshore oil and gas licensing round this year which could result in more parts of the UK being opened up for shale exploration. |

|