|

|

Post by principled on Feb 9, 2013 16:27:07 GMT 1

Marchesa I sometimes despair of the UK and its leaders. According to BBC News, If this were in any other sphere of living, then the tree hugging green lobby would be out with their placards demonstrating solidarity with 8+ million affected. But because this poverty impinges on the holy grail of CO2, a deathly silence ensues. It is interesting that even before the actual reserves are made public our political masters are making sure that they manipulate our expectations about fuel costs to ensure that whatever the wholesale price falls to we will not expect a drop in retail prices. It would seem that the thought of the size of the tax take is far more appealing than reducing fuel poverty. BTW: Note that the pre-shale peak was around 13 dollars/million BTUs, now it's $9. But I thought our prices had to go up to cover increasing NG prices. Interesting!  P From:http://www.bloomberg.com/news/2012-12-12/u-k-natural-gas-advances-as-temperature-drops-to-10-month-low.html |

|

|

|

Post by alancalverd on Feb 10, 2013 2:12:34 GMT 1

Of course the price will go up!

Our dear Prime Minister, that source of infinite wisdom, announced yesterday that the UK's contribution to the EU will increase next year, and this is a Good Deal for Britain!

Taxes are a Good Thing! (Unless you are very rich, of course, then you don't have to pay them)

|

|

|

|

Post by marchesarosa on Feb 14, 2013 11:10:04 GMT 1

Andrew Montford writes PriceWaterhouseCoopers have issued a report on the impact of shale gas on the economy, which seems to take a rather different view to previous pontifications on this subject. According to BBC Business, PWC reckon that shale will add a trillion dollars to world GDP, with conventional producers like Russia being big losers. In a second story, on the Scotland pages, it is revealed that the report's authors expect oil and gas prices to be significantly depressed by a surge in shale production. I'm sure Mr Cameron will see this as an opportunity to apply further taxes. more here www.bbc.co.uk/news/business-21453393www.bbc.co.uk/news/uk-scotland-21447025bishophill.squarespace.com/blog/2013/2/14/a-change-in-the-shale-story.html |

|

|

|

Post by alancalverd on Feb 14, 2013 17:09:54 GMT 1

If Dave wants to be really, really popular, he'll have a referendum in England on Scottish independence.

Having achieved massive popularity on both sides of the border with an overwhelming "yes, if not immediately, how about tomorrow?" he can then go on to secure a lasting peace in Ireland by asking the English taxpayer if we really want to support the criminals who sit in Stormont, or let the Six Counties be screwed by the embezzlers who sit in Leinster House.

Then he can reduce taxes and be elected as life president of England.

Money talks.

|

|

|

|

Post by marchesarosa on Feb 17, 2013 2:21:53 GMT 1

Nice idea, but it's not democratic to use the inbuilt majority of the much larger English population to oust Scotland from the Union.

|

|

|

|

Post by marchesarosa on Feb 17, 2013 2:22:34 GMT 1

BRITAIN NEEDS A SERIOUS DEBATE ON SHALE GAS Date: 15/02/13 Dan Byles, The Spectator blogs.spectator.co.uk/coffeehouse/2013/02/the-uk-needs-a-serious-debate-on-shale-gas/Arguments over the potential development of UK shale gas resources are too often characterised by rhetoric and hyperbole on both sides. Some of the wilder claims need to be challenged and we need to separate the facts from the ill-informed speculation. That is why I am one of a cross-party group of MPs and Peers who have come together to set up the new APPG. Members include MPs who are in favour of developing a domestic shale gas industry, MPs who are opposed, and MPs who simply want to better understand the truth. The intention is to cut through the rhetoric and get to the facts. Much of the excitement over the potential benefits of shale gas come from those who cast an eye across the Atlantic at the transformation shale gas has wrought on American energy prices. As US shale gas production has soared, the price of gas in the US has fallen by two thirds to a ten year low. Average electricity prices in the US fell last year by more than a quarter. Not all of these changes can be attributed solely to the shale gas boom, but it is undoubtedly a significant contributor. To give an idea of the scale of the growth in US production, the state of Pennsylvania alone – with a population of just 12 million – went from producing zero natural gas to overtaking the entire output from the North Sea in just four years. The impact of structurally lower energy prices have been significant, not just for hard pressed consumers but for the wider economy. The US has seen an unexpected boom in energy intensive industries such as steel, and in the chemicals industry. Some companies are taking advantage of cheaper gas prices by relocating back to the US, production which had previously been moved offshore. The statistics I find most remarkable are the International Energy Agency’s predictions that the United States will overtake Russia as the words biggest producer of natural gas by 2015, and will overtake Saudi Arabia as the worlds biggest producer of oil by 2020. We may need to prepare for a world in the which the US is no longer reliant on the Middle East for oil but is energy self-sufficient, and the geopolitical implications of that. However, the economic impact is not the only picture. As the production of shale gas and unconventional oil continue to rise (shale gas is expected to account for almost half of all US gas production by 2035), so too has the controversy. Accusations of environmental damage and water pollution have dogged the US shale industry, leading to fracking bans in a number of states. A hard hitting documentary called ‘Gasland’ took the internet by storm in 2010 with its dramatic images of people setting fire to their tap water, allegedly as a result of fracking for shale gas. While that claim is widely believed by experts to be mistaken, there is a large and growing anti-fracking movement that cannot be ignored. That movement is already active here in the UK. The reason the debate is about to take off in Britain is due to the rapidly changing picture with regard to our own shale gas resources. Two years ago, the Energy & Climate Change Select Committee (on which I sit) looked at UK shale gas potential and concluded it was unlikely to be a game changer. At that time the British Geological Survey estimated British onshore shale gas resources to be in region of 5.3 trillion cubic feet (TCF). In just a few weeks time they are expected to dramatically increase that estimate to 1300-1700 TCF. That would make us one of the most shale gas rich nations on the planet. This is the total amount of gas in place, not the economically recoverable figure which will be a lot lower. However, that is still a huge amount of shale gas – too much to be ignored. We don’t yet know what the technically and economically feasible recovery rates in the UK might be. In the United States average recovery rates are around 18 per cent. If we were to access just 10% of the lower end of this estimate, that would be 130 TCF. To put that in context, the entire North Sea gas production from 1970 to 2011 was just under 85 TCF. It’s no surprise that shale gas is getting some people very excited. As a country we have some important decisions to make, but there are still too many unanswered questions. Just how much shale gas is realistically recoverable, and at what price? What are the real environmental effects of fracking, and what would be the effect on local communities? What impact could shale gas production at scale have on our climate change commitments? What could be the impact, if any, on UK energy prices? How many jobs might a domestic shale gas industry create? How much tax revenue might the government expect? It is to consider questions like these that the All Party Parliamentary Group has been set up, and I am very excited to be chairing it. We will interrogate companies involved in the onshore gas industry, government officials and both industry and environmental regulators. We will hear from respected academic organisations such as the the Royal Society, the British Geological Survey, the Durham Energy Institute, Manchester University School of Earth, Atmospheric & Environmental Sciences and others. We will consider the detailed economic analysis currently being put together by the Institute of Directors. And we will hear about the environmental concerns from organisations such as Friends of the Earth and WWF. The Chief Economist of the International Energy Agency, Fatih Birol, has described unconventional oil and gas as the most significant development in energy since the Second World War, with massive economic and geopolitical implications. The UK could be sitting on one of the worlds largest shale gas deposits. These are questions we can no longer afford not to answer. Dan Byles is the Conservative MP for North Warwickshire and chair of the All Party Parliamentary Group for Unconventional Oil & Gas. The Spectator, 14 February 2013 |

|

|

|

Post by alancalverd on Feb 17, 2013 13:05:05 GMT 1

Nice idea, but it's not democratic to use the inbuilt majority of the much larger English population to oust Scotland from the Union. Apologies for wandering off topic, but (a) democracy is the means of imposing the will of the majority on the minority (b) capitalism is the means by which the person who pays chooses where to spend his money, (c) surgery is the process of cutting off peripheral small irritants to preserve the wellbeing of the main body and (d) such a move would be consistent with a majority decision in Israel to abandon the occupied territories, which would, I am robustly told, please everyone. A democratic capitalist shouldn't ask a parasite it wants to stay attached to its host. Same logic applies to the Six Counties. |

|

|

|

Post by marchesarosa on Apr 12, 2013 13:59:24 GMT 1

SHALE THREATENS RUSSIA’S ECONOMY

Date: 11/04/13 James Marson, The Wall Street Journal

Russia’s oil exports could plunge in the coming decades as the U.S. ramps up output of shale oil, a group of government-linked experts said, in an unusually frank admission that the North American energy boom poses a threat to Russia’s hydrocarbon-fueled economy.

Russia, the world’s largest energy producer, is already seeing its natural-gas exports shrink, partly as a result of the U.S. shale-gas boom. Government officials have raised concerns in recent months that dwindling gas exports are holding back economic growth and costing the government billions of dollars in lost revenue.

Wednesday’s report by the Russian Academy of Sciences’ Energy Research Institute said the increasing output of shale oil, particularly in the U.S., could also threaten Russia’s crude-oil exports.

If the “shale breakthrough” expands, it could reduce Russia’s forecast exports by as much as 50 million tons a year by 2040, the report said. Russia last year exported 240 million tons of oil.

That, in turn, could cause the energy industry’s share of Russia’s gross domestic product to fall from over one-quarter in 2010 to just over 15% by 2040, it said. About half of Russia’s federal budget comes from oil and gas.

|

|

|

|

Post by marchesarosa on Apr 12, 2013 16:44:23 GMT 1

SHALE GAS MAKES SLOW INROADS INTO EUROPE’S ENERGY MIX Date: 11/04/13 Frank Umbach, Geopolitical Information Service The rewards of shale gas are starting to outweigh the potential risks of getting the energy source out of the ground for a number of European countries. Reserves of the gas are now thought to be much larger in some states than previously estimated. In others, there is growing concern over the dominance in the market of the United States. Some are also keen to break their dependence on Russian conventional gas. MANY of the shale gas fields in Europe are situated in areas where the geology makes it much harder to extract than those in the United States. They are also in places with much higher population densities than the US, and their service industries and infrastructure for the industry are much less developed. These obstacles have dissuaded, until recently, a number of European countries from developing their own resources, particularly where there is strong opposition over potential environmental risks. But the balance is starting to shift, with more countries actively considering either starting shale gas production or expanding existing industries. The one major exception is France, where the debate over shale gas production is still raging. New geological analyses in Germany and the UK have confirmed that their shale gas resources are considerably bigger than previously estimated. United Kingdom The British government lifted a ban in December 2012 which had been in place since May after the British Geological Survey revealed there was an estimated 1,700 trillion cubic feet (tcm) of reserves, which is 200 times more than previously estimated. Around 10-20 per cent of the newly estimated resources are considered to be economically recoverable. The government announced a new gas generation strategy in December 2012 which will allow for the construction of 20 new gas-fired power plants. This would increase net capacity of total British powered plants by 5GW (gigawatt) by 2030. The British Chancellor of the Exchequer, George Osborne, recently committed the UK to an exploration drive for shale gas in the UK by promising tax allowances for companies developing shale gas fields. He also said he would develop proposals to ‘ensure local communities benefit from shale gas projects in their area’. Energy companies expect it will take up to five years for production to get underway on a commercial scale. A review by The Royal Society and Royal Academy of Engineering in the UK has concluded that the controversial process by which shale gas is extracted from the ground, known as fracking, can be managed effectively and enforced through strong regulation. In Northern Ireland, shale gas deposits could be worth US$121billion, according to a new study by the consulting company PwC. Much more detail about other European nations here www.naturalgaseurope.com/pdfs/GIS%2041%20-%20Shale%20Gas%20Update%20II%20260313.pdf |

|

|

|

Post by marchesarosa on Apr 14, 2013 17:34:54 GMT 1

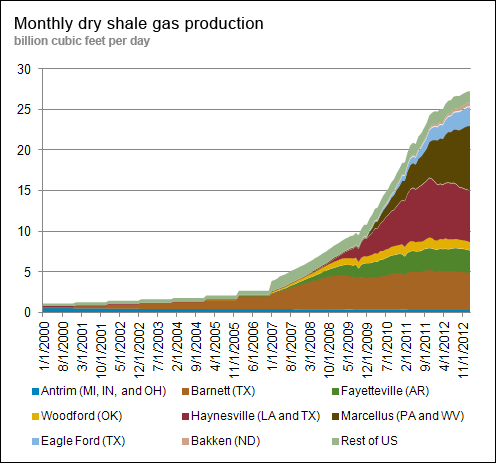

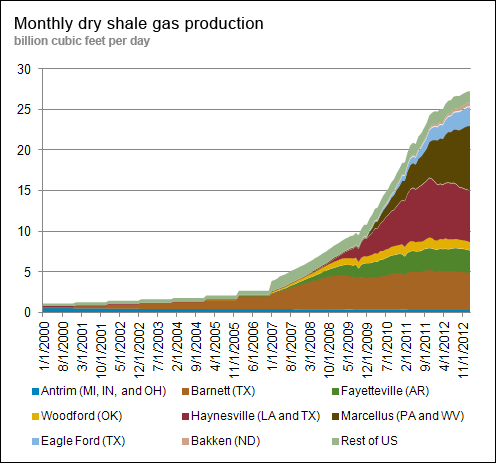

According to Energy Information Administration (EIA) data released 4/11/2013, dry shale natural gas production in the U.S. is 27 times higher today than it was in January of 2000. Most of that dramatic increase came after 2006. To understand how remarkable that is, it is instructive to compare it with the much vaunted renewable energy industry.  Dry shale production has doubled every year for each of the last 6 years. more here informthepundits.wordpress.com/2013/04/13/shale-natural-gas-is-fracking-impressive/ |

|

|

|

Post by marchesarosa on May 9, 2013 18:00:18 GMT 1

Cracking comment from Peter Lilley MP in the Spectator, full article here www.spectator.co.uk/features/8905731/the-only-way-is-shale/The scandal of official reluctance to develop Britain’s shale gas potential is at last beginning to surface. It may prove to be the dress rehearsal for the ultimate drama — the inexorable collapse of our whole energy strategy. Most of us have by now heard about the US shale gas revolution. In little more than six years, shale gas has reduced America’s gas prices to a third of what they are in Europe, increased huge tax revenues, rebalanced the economy, created tens of thousands of jobs, brought industry and manufacturing back to the country’s heartlands, and given rise to a real prospect of American energy self-sufficiency by 2030. Britain may well have comparable shale resources. Indeed, the Bowman shale in Lancashire is a mile thick, whereas most US shale plays are just 300 to 500 feet thick — a strangely unpublicised piece of good news. If shale gas proves abundant it could help the government meet three key objectives: rebalancing the public finances by generating large tax revenues, rebalancing the economy by boosting manufacturing, and rebalancing the north/south divide by creating jobs and a whole new industry in the north. We will only know for sure how much is there, and can be economically extracted, by drilling. So you might assume governments would be forcing the pace. Far from it. In 2011, the government imposed an 18-month moratorium. Why is Britain dragging its feet? It is all the more puzzling because there is a widespread belief that governments are putty in the hands of Big Oil. The surefire way to win a burst of applause on Question Time is to assert, when anyone mentions the Iraq and Afghan wars, that ‘the real reason we went to war was oil’. Yet the petroleum industry has been singularly unsuccessful in galvanising the British government to open up its own shale resources. Whatever the power of Big Oil in the past, it has been eclipsed by ‘Big Green’. The green lobby is in control of the Department for Energy (to the Treasury’s dismay), its objectives are enshrined in law, it dominates the EU, and it is institutionalised in Whitehall via the Climate Change Committee. These state bodies are egged on by powerful environmental NGOs, which are heavily financed by the EU (WWF receives €600,000 and Friends of the Earth Europe €1.2 million) and our government (we pay WWF £4.1 million) to create the semblance of popular support. These NGOs can deploy any uncorroborated scare story in their war against fossil fuels. There is a legitimate argument that the world should phase out fossil fuels to minimise global warming. The power of that argument has weakened recently. Global temperatures have failed to rise for 16 years. Recent measures of how much global temperature rises as carbon dioxide in the atmosphere increases are far lower than is built into climate models. The case for unilateral action to decarbonise the EU economy has weakened because China, India, USA et al won’t do likewise. Even EU solidarity is crumbling now that Germany is shutting its nuclear plants and building 20 new coal ones. So the idea of Britain going it alone is risible. When pessimism about reserves and prices fail, the green lobby deploys scare stories with a reckless disregard for the truth comparable to the MMR scare. They claim fracking will harm the water table and trigger earthquakes. The Royal Society and Royal Academy of Engineering has dismissed fears about water contamination. It concluded that any ‘health, safety and environmental risks associated with hydraulic fracturing… can be managed effectively in the UK as long as operational best practices are implemented and enforced’. The British Geological Survey debunked the earthquake scare by pointing out that Britain annually experiences 150 natural or mining-related shocks of similar or greater strength without complaint, campaigns or moratoria on mining. But green campaigners — who denigrate anyone who queries the ‘scientific consensus’ on climate change — reject out of hand the evidence of our official scientific and geological bodies when it refutes their position. Fracking simply means pumping water under great pressure into shale beds several kilometres underground; tiny fissures open up which are then kept open by grains of sand so that the gas can flow out. Fracking itself lasts a few days — thereafter the field pumps gas much like any conventional field. Fracking is a tried and tested technology, used since 1947. More than 100,000 wells have been fracked in recent years. Before being ousted from the Department for Energy and Climate Change, John Hayes acknowledged that not a single person had been poisoned by fracking contaminating the water table. Nor has a single building been damaged by the almost imperceptible seismic tremors. Moreover, where UK shales are a mile thick, a single rig may be able to access shales that would require up to 20 drilling sites in the USA. Other than nuclear power, which is painfully slow and increasingly expensive, there are simply no affordable renewable technologies available to replace fossil fuels. Wind, solar, tidal — all need fossil fuel back-up for the substantial periods when wind, sun and tide are not available. And the lowest-carbon fossil fuel is gas. That is why DECC’s central projection actually shows Britain using more gas in 2030 than it does now. Maybe it is the realisation that Britain is rapidly approaching a crisis of our own making that explains the sudden resignation of Jonathan Brearley, the civil servant who masterminded the Energy Bill currently going through Parliament, followed by the DECC’s director of strategy, Ravi Gurumurthy. The Department for Energy and Climate Change is in disarray. With luck this will prompt ministers to question the direction in which they have been heading. Some day, viable alternatives to fossil fuels will become available. But any policy based on the assumption that this is imminent is doomed to fail. The sooner we wake up to that fact and throw off the thrall of Big Green, the better. Peter Lilley is MP for Hitchin and Harpenden and is a member of the Prime Minister’s Parliamentary Advisory Board |

|

|

|

Post by marchesarosa on May 23, 2013 14:25:38 GMT 1

EU LEADERS BACK SHALE GAS REVOLUTION, ROLL BACK CLIMATE POLICYDate: 22/05/13 EUobserver EU energy policy must shift towards diversifying supply, with natural shale gas likely to be part of the mix, EU leaders said at a summit in Brussels on Wednesday. The emphasis on competitiveness and prices is an indication that environmental and climate concerns are falling down the EU’s list of priorities.UK Prime Minister David Cameron offered robust support for European exploitation of shale gas, telling journalists: “No regulation must get in the way.” “Europe has 75 percent as much shale gas as the US, yet the Americans are drilling 10,000 wells per year while we in Europe are drilling less than 100,” he noted. He added it is “no surprise that over the last decade Americans have increased their energy from shale from just 1 percent to 30 percent, and here in Europe we are now paying twice what the US pays for wholesale gas.” For his part, European Council President Herman van Rompuy said the summit was the “right moment for a strategic debate on European energy policy.” He noted that “Europe will soon be the only continent dependent on imported energy.” He also called for increased investment in energy infrastructure and efficiency in a bid to cut costs. Energy prices in Europe are over twice the levels in the US. The emphasis on competitiveness and prices is an indication that environmental and climate concerns are falling down the EU’s list of priorities, however. In advance of the summit, an EU official confirmed the energy talks would be “through the lens of prices rather than climate concerns.” euobserver.com/news/120202

|

|

|

|

Post by marchesarosa on Jun 3, 2013 9:22:45 GMT 1

Gas prospector IGas has announced that there could be huge quantities of shale gas in the area it has been licensed to explore (story www.bbc.co.uk/news/business-22748915 ). The company's licences cover an area of 300 sq miles across Cheshire. It had previously said it had about nine trillion cubic feet of shale gas. It now estimates that the volume of "gas initially in place" could range from 15.1 trillion cubic feet to 172.3 trillion cubic feet - nearly 20 times more. To put that in perspective, UK demand is currently about 3TCF per annum, so we are talking about a lot of gas. Of course, there's the question of how much is extractable, but this is still very good news. bishophill.squarespace.com/blog/2013/6/3/cheshire-gas.html |

|

|

|

Post by marchesarosa on Jul 19, 2013 8:46:42 GMT 1

‘Significant shale production’ could see UK prices fall by 28%Jason Torquato and Tom Hoskyns interfaxenergy.com/natural-gas-news-analysis/european/significant-shale-production-could-see-uk-prices-fall-by-28/18 July 2013 | 15:13 GMT For UK prices to fall, existing supply flexibility must remain in place, including LNG deliveries. (Dragon LNG)

UK gas prices could fall by 28% by 2030 if shale production in the UK and continental Europe is significant over the coming decades, according to a report prepared for the UK’s Department of Energy and Climate Change (DECC) by Navigant Consulting.

Following the release of a study by the British Geological Survey that shows there could be 40 trillion cubic metres of shale gas resources in England alone, the impact of these reserves on the UK’s gas prices has been a hot topic.

If the UK and continental Europe combine to produce around 100 billion cubic metres per year of unconventional reserves between 2020 and 2030, Navigant expects “a combination of local gas and readily available LNG puts sufficient pressure on oil price-indexed gas supplies that gas prices fall towards the long-run marginal cost, getting to 50 pence per therm [p/th] by 2030”.

Under this ‘low price scenario’, Navigant believes continued cost efficiencies could even “move prices downwards to somewhere between 35 p/th and 50 p/th”. The fall would mean prices have the potential to halve from 2012’s average trade price of 69 p/th, making the UK’s shale resources an undoubted ‘game-changer’.....more We'll see! Exciting times! It could be that this new source of energy could cause a new Industrial Revolution throughout the world! Let's hope so. Fears were that China would gobble up ever more of the world's energy driving up prices but now it looks like there will be more than enough to go round for everyone with perhaps even falling prices! The concept of Peak Oil, indeed Peak Anything, seems to have died the appropriate death! The alarmists will have to find a new source of worry!

|

|

|

|

Post by marchesarosa on Jul 19, 2013 8:59:34 GMT 1

BJØRN LOMBORG TELLS GUARDIAN READERS: FRACKING IS GOOD & GREEN Bowland Shale fracking could reignite UK economy and cut CO2 emissions The world's largest shale-gas field – underneath Lancashire and Yorkshire – could add £7bn a year to the UK economy and create thousands of jobs 16 July 2013 In late June the British Geological Survey announced the world's largest shale-gas field. The Bowland Shale, which lies beneath Lancashire and Yorkshire, contains 50% more gas than the combined reserves of two of the largest fields in the United States, the Barnett Shale and the Marcellus Shale.

The United Kingdom has been reluctant to join the hydraulic-fracturing (or fracking) revolution. Yet tapping the Bowland Shale could reignite the UK economy and deliver huge cuts in CO2 emissions.

At the same time, the UK parliament has approved stringent new measures to reduce carbon emissions by 2020, with the biggest CO2 cuts by far to come from an increase of more than 800% in offshore wind power over the next seven years. But offshore wind power is so expensive that it will receive at least three times the traded cost of regular electricity in subsidies – more than even solar power, which was never at an advantage in the UK. For minimal CO2 reduction, the UK economy will pay dearly.

This is just one example of current climate policy's utter remove from reality – and not just in the UK. We are focusing on insignificant – but very costly – green policies that make us feel good, while ignoring or actively discouraging policies that would dramatically reduce emissions and make economic sense.

Consider the three standard arguments for a green economy: climate change, energy security and jobs. As it turns out, fracking does better on all three ....

more www.guardian.co.uk/business/economics-blog/2013/jul/16/bowland-shale-fracking-uk-economy-co2-emissions |

|